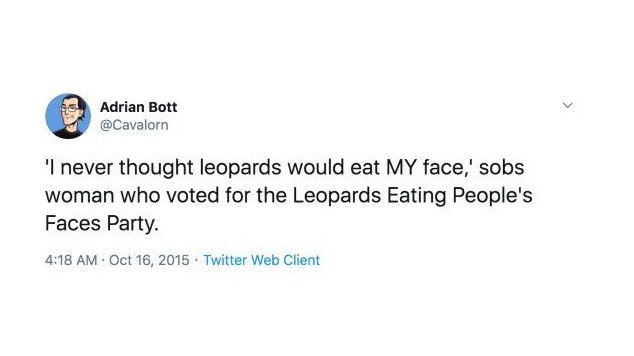

It’s been a popular sentiment that markets were under the impression Donald Trump would engage in actions favorable to them and avoid those that aren’t. As events have unfolded, the reality has been somewhat different.

The fast-paced adjustment that Wall Street analysts have had to make is epitomized by a note from Standard Chartered, presumably written before recent developments, which suggested that tariff worries had eased slightly since Trump was preoccupied with domestic matters in his initial weeks. Well, that assumption quickly met reality.

Standard Chartered was not alone in harboring such optimism. Many analysts found their weekend plans hampered by Trump sticking to long-made promises, a twist even seemingly unexpected by his own Treasury Secretary.

Below, I’ve gathered excerpts from various investment notes that came to Alphaville’s attention after the tariff news broke. Updates will follow as more analyses come in. Notably, Philip Marey from Rabobank doesn’t hold back in his commentary:

"Perhaps it’s time for analysts who thought Trump’s tariff threats were empty to start taking his words more seriously and stop clinging to illusions."

A Sell-side Summary

George Saravelos of Deutsche Bank has expressed surprise at the rapid implementation and extensive reach of these tariffs. His previous caution about the market’s complacent attitude towards trade war risks now seems prescient:

"[…] The announcements represent the most hawkish protectionist measures imaginable. The swift implementation (12:01am EST, Tuesday), coupled with the broad scope (including previously untaxed small parcel goods) and coverage (44% of US imports), is aggressive. The inclusion of energy imports from Canada, even at a reduced 10% rate, refutes the idea that living costs would limit tariff actions. These tariffs could have broad and significant macroeconomic disruptions, particularly outside the US."

Saravelos further suggests that the market needs to drastically re-evaluate the trade war risk premium, noting that prior assumptions significantly underestimated the potential impact:

"We have estimated a threefold increase in potential tariff impacts, with possibly a 1% hike in US headline inflation if these rates persist. The tariffs now are sizeable compared to previous Trump administration actions. For Canada and Mexico, this trade impact could rival or exceed the economic repercussions seen from Brexit on the UK."

Goldman Sachs took an initially optimistic view, predicting that such tariffs might uplift core US inflation by 0.7 percentage points and trim economic growth by 0.4 percentage points. However, they acknowledge that they need to revise these projections in light of recent tariff details:

"President Trump signed off on tariffs amounting to 25% on Mexican and Canadian imports, excluding energy which has a 10% rate, and 10% on Chinese imports, adding to existing tariffs. The specific items eligible for lower energy tariffs will likely include oil, gas, and electricity…"

Goldman Sachs further details potential economic ramifications and hints at a temporary nature for the tariffs, contingent on issues like immigration and fentanyl:

"The upcoming tariffs, to be imposed in just two days, seem set to proceed barring last-minute changes. Given their economic weight and the conditions set for their removal, there is a possibility of them being transient, though the outlook remains uncertain."

Morgan Stanley sees a greater potential hit on growth and inflation, predicting a significant recession in Mexico and advocating that US legal systems could block these tariffs:

"Our economists expect fully realized tariffs to have substantial consequences. US inflation could increase by 0.3 to 0.6 percentage points in the short term, with growth potentially declining by as much as 1.1 percentage points over the coming quarters. Courts could play a role in contesting these actions, as there are debates over their legal grounding."

Saravelos of Deutsche Bank also discusses the possibility of legal roadblocks but highlights that the Trump administration has other avenues to pursue these tariffs if challenged:

"The broadened use of executive power under IEEPA is likely to face immediate legal opposition. However, even if an injunction is granted, Trump harbors other measures to implement tariffs, as demonstrated in previous trade memo analyses."

Some, like Peter Tchir from Academy Securities, remain quietly hopeful that the link to fentanyl could serve as an off-ramp, minimizing the long-term impact:

"[…] This situation appears to have a potential exit strategy, merely by intensifying the battle against fentanyl. While short-term currency fluctuations and a temporary tariff landscape might not significantly alter supply chains, long-term effects could be minimal for consumers."

The key question now is how markets will react to all of this. Initially, the dollar has climbed, US equity futures might see some volatility, and despite initial plunges, $TRUMP has mildly rebounded over the last 24 hours, though still markedly below its peak.

With main trading sessions yet to kick off, it’s still uncertain how markets will digest these developments. Saravelos provides some insight:

"The market response magnitude and the administration’s reaction to it will be telling. The President appeared dismissive of market reactions recently, yet the expected USD/CAD surge could cause more volatility, particularly in closed markets like China due to the Lunar New Year. The broader response might align with a combined fiscal tightening and negative supply shock view, likely to impact equity markets adversely, depending considerably on expected fiscal countermeasures."

Saravelos points out that a reciprocal response from countries like Canada has already begun, potentially creating further escalation. There’s still room for de-escalation, but time is of the essence:

"The longer it takes without constructive communication, the more likely these tariffs are to be perceived as permanent—exacerbating market reactions."

Even amidst uncertainty, there’s a glimmer of optimism. Philip Marey from Rabobank, however, believes the time for underestimating Trump’s threats is over:

"Trump has dispelled misconceptions about his tariff threats with quick action against major trade partners, foreshadowing more aggressive moves in the future."

Oops, it seems Anthony Pompliano has announced an upcoming newsletter aimed at dismantling the worry over these tariff developments. Hold on, crisis adverted perhaps?