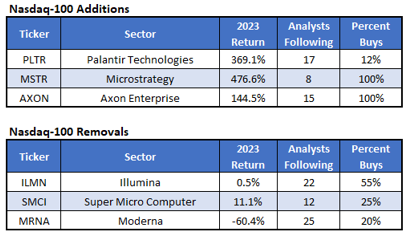

It’s that time of year again—the annual reshuffle of the Nasdaq-100 Index (NDX). This index showcases the 100 largest non-financial companies trading on the Nasdaq stock exchange. This past Monday brought some movement: three new companies found their way into the index while three others made their exit. Being part of a high-profile index often sparks interest from ETFs and index funds, leading to buying pressure, while being removed usually triggers selling. The changes were announced a couple of weeks back, so much of the action has already taken place prior to this week.

I’m taking a closer look at what typically happens when stocks start trading in the index. There’s a belief that these announcements alter market sentiment, sometimes causing the initial reactions to overshoot, which could open up future opportunities. First, though, let’s check out which companies were added and which were removed.

Let’s rewind to 2010, when I began tracking the performance of 80 stocks added to the NDX and 73 that were removed. Keep in mind, some stocks aren’t trading anymore, and I’m only focusing on those added or removed during December’s rebalancing—not those affected mid-year by bankruptcies or mergers. When examining performance, stocks removed from the index actually fared better than those added. On average, new additions to the index saw a 3.81% return over the following three months, while those removed enjoyed a 7.27% gain.

Within that same three-month period, fewer than half of the newly added stocks managed to outperform the NDX, whereas 56% of the stocks that were removed surpassed it. A year out, newly included stocks averaged a 12% gain, with 40% beating the index, yet again underperforming compared to removed stocks which averaged an 18% rise, with 52% beating the NDX. It seems sentiment often becomes overly optimistic for new additions and overly pessimistic for stocks on their way out.

In my next analysis, I reviewed analyst ratings to pinpoint stocks with extreme sentiment. Added stocks generally meet with overly optimistic expectations. When looking into the data, I zeroed in on stocks added with at least 80% of analysts giving a “buy” recommendation on their induction day, suggesting potential excess bullishness. On the flip side, I studied stocks removed with 20% or fewer firms recommending a “buy,” highlighting potential bearishness. If this hypothesis holds, overly bullish additions might lag, while overly bearish removals may perform well.

Further examining these findings, removed stocks with a “buy” sentiment from 20% or fewer analysts saw an average return of 34% in the subsequent year, with 58% outperforming the index. This observation hints at potential investment opportunities in companies like Moderna (MRNA) and Super Micro Computer (SMCI). Meanwhile, it’s probably smart to sidestep those added stocks where over 80% of analysts advocate for a “buy,” as they managed under a 5% gain on average, with just 22% beating the NDX. For instance, Axon Enterprise (AXON) joined the index with unanimous “buy” ratings from 15 firms, suggesting it could struggle to meet expectations. On the other hand, MicroStrategy (MSTR) didn’t fit my dataset as it didn’t have enough brokerage coverage. Still, with eight analysts suggesting a buy for SMCI, there are expectations it might not perform as well as anticipated.